The perceived significance of Utah’s housing affordability problem has been growing over time. Prior to 2018, it was never among the Utah Priorities Project’s top 10 issues. It hit 2nd place in 2020, prior to the pandemic, but dropped in significance as COVID spread. In 2024, housing affordability has become the most important issue. This brief highlights how demographic factors relate to housing preferences and shows price trends.

Housing Ranking and Demographic Influence

In 2024, housing affordability was an important issue for most demographic subgroups. For instance, housing affordability was a top priority across gender, age, political affiliation and ideology, and educational attainment. Even though it was a top priority across demographic groups, some groups still prioritized it higher than others. Groups that tended to be most concerned about housing affordability were those earning less than $40,000, those younger than 65, and renters.

Housing Concern by Demographic Group

Low-income Utahns are no longer seen as the top group needing housing assistance. Since 2020, voters have become less concerned about affordable housing for low-income Utahns and more concerned about affordable housing for first-time home buyers.

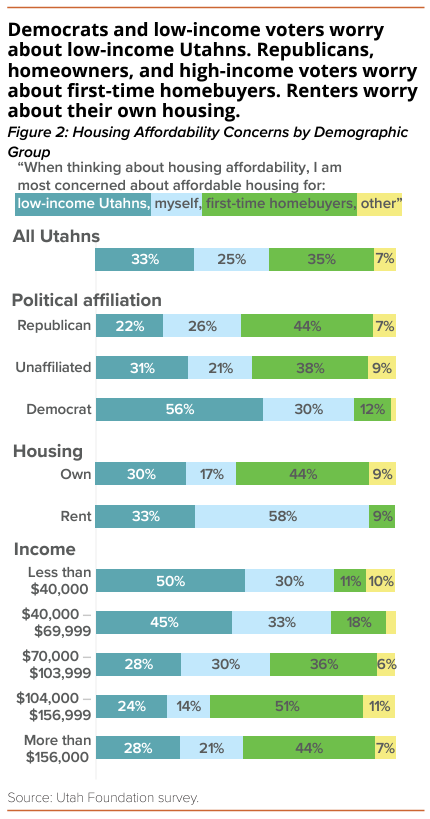

The concern about affordable housing for voters themselves is similar for 2020 and 2024. (See Figure 1.) Those desiring more affordable housing for themselves (and not other groups) were also more likely to list housing as a top priority in their lists. Utah’s renters are by far the most likely group to prioritize affordable housing for low-income groups and themselves. (See Figure 2.)

Policy preferences varied widely by other demographic groups as well. For example, those most concerned with first-time home buyers were more likely to be conservative, higher income, non-Hispanic white voters. Democrats and lower-income voters worry about low-income Utahns. Specifically, those earning less than $70,000 preferred affordable housing for low-income Utahns. (See Figure 2.)

About 56% of Democrats want affordable housing for low-income Utahns, compared to 22% of Republicans. About 44% of Republicans desire affordable housing for first-time home buyers, while only 22% of Democrats feel the same way. (See Figure 2.) Preferences broken out by ideology followed similar patterns.

Housing Market Conditions

For Utahns, housing has become a more important issue since 2016. This is likely because housing prices have increased by 50% since 2020 and doubled since 2016.11 (See Figure 3.)

While the slowing of median home sales prices increases may be encouraging, it should be noted that the recent trend is slightly upward.22 Further, it is not clear whether the lower prices since the 2022 peak are because home prices are lower or only cheaper houses are being sold. The Case-Schiller Price Index (which tracks the price of single-family houses against their previous sale prices) may cast suspicion on the notion of falling prices. This index shows that prices of resales nationally have increased to a level today well above previous peak home valuations.33 While home prices may now be above their 2022 peak, the houses that are currently being sold are still being sold at a lower price than 2022.

Further exacerbating the local housing situation, median rents in Utah increased by 4.3% between March 2023 and March 2024, with the Salt Lake City metro area median rent increasing by 4.5%. This represents the 18th fastest rent growth among America’s 50 largest metro areas.44 Median rent for all homes in Utah is currently $1,895.55 This is 11% below the national average, $225 lower than Colorado, $145 less than Idaho, $205 less than Nevada, and $200 less than Arizona. However, rent increases in Utah also seem to be more persistent relative to those elsewhere in the West.66 For example, rents in Denver and Las Vegas decreased by between 4.3% and 5.3% in the year preceding March 2024.77

Recent Utah Foundation Research

The Utah Foundation has recently released four research reports related to housing. A few key findings from those reports are:

- The elimination of lien rights – without an option being employed to protect actors in the construction industry from non-payment – may slow the construction industry when the state can least afford it.88

- Recent household incomes were only about 20% higher than in 1985, while home prices had increased by 90% (adjusting for inflation). Obviously, this does not account for the fact that the 30-year fixed rate mortgage was 13% in 1985. Once you account for that you find that the mortgage payment in 2024 is only 3% more expensive (adjusting for inflation) while incomes are 20% higher, meaning that housing today is relatively less expensive than 1985 even though home prices are 90% more expensive.99

- Encouraging construction density can improve homeowner affordability as height limits are increased or smaller lots are embraced in neighborhoods otherwise characterized by single-family homes.1010

- Many municipal officials and staff see the most substantial barrier to affordable housing as emanating from community opposition (56%).1111

Please see the full reports for more details.

Endnotes

- Zillow, “Utah Housing Market,” 2024, https://www.zillow.com/home-values/55/ut/?.

- Ibid.

- Federal Reserve Bank of St. Louis, “S&P CoreLogic Case-Schiller U.S. National Home Price Index,” 2024 https://fred.stlouisfed.org/series/CSUSHPINSA.

- Gardner, Anthony, “The Rent Report,” 2024, https://www.rent.com/research/average-rent-price-report/.

- Zillow, “Utah Rental Market,” 2024, https://www.zillow.com/rental-manager/market-trends/ut/.

- Ibid.

- Ibid.

- Utah Foundation, “Brick by Brick: Methods of Stabilizing Utah’s Construction Sector,” 2023, https://www.utahfoundation.org/wp-content/uploads/rr813.pdf.

- Utah Foundation, “Moving Utahns Toward Homeownership: Benefits, Rates, Affordability, and Obstacles,” 2024, https://www.utahfoundation.org/wp-content/uploads/rr818.pdf; Freddie Mac, “30-year fixed rate mortgage average in the United States,” 2024, https://fred.stlouisfed.org/series/MORTGAGE30US. A $500,000 house in 2024 would have cost $90,023 in 1985, accounting for inflation and a 90% discount in housing price. A 30-year mortgage with 6% on $500,000 in 2024 would have a mortgage payment of $2,991. This would be equivalent to $1,023 in inflation-adjusted terms in 1985. A 30-year mortgage with 13% on $90,023 in 1985 would have an monthly mortgage payment of $995. Taking lower interest rates into account, a monthly payment on a mortgage would have increased 3% comparing 1985 to 2024.

- Utah Foundation, “Boosting Utah’s Homeownership Affordability: Strategies and Solutions for State and Local Governments,” 2024, https://www.utahfoundation.org/wp-content/uploads/rr820.pdf.

- Utah Foundation, “An Appetite for Housing Affordability: Insights from Utah’s Municipal Officials,” 2024, https://www.utahfoundation.org/wp-content/uploads/rr822.pdf.