Taxes are everywhere. The small amount added to each purchase. The difference between your promised salary and what shows up in your bank account. The pennies added to each gallon of gas. The additional fee added to a water bill to cover sewerage services. So much of the public policy debate is focused on how to collect taxes, and what services they fund. This report, however, merely examines the aggregate burden of state and local taxes and mandatory fees to the residents of each state.

The Utah Foundation periodically reviews the state’s tax burden. The previous report, published in 2019, used the latest data available, up to 2016. The report found that the state’s tax burden in 2016 was the lowest it had been in 25 years. Several tax changes and a global pandemic have shaken things up since then. This report highlights changes in Utahns’ tax and fee trends from 2016 to 2021.

Highlights of this Report

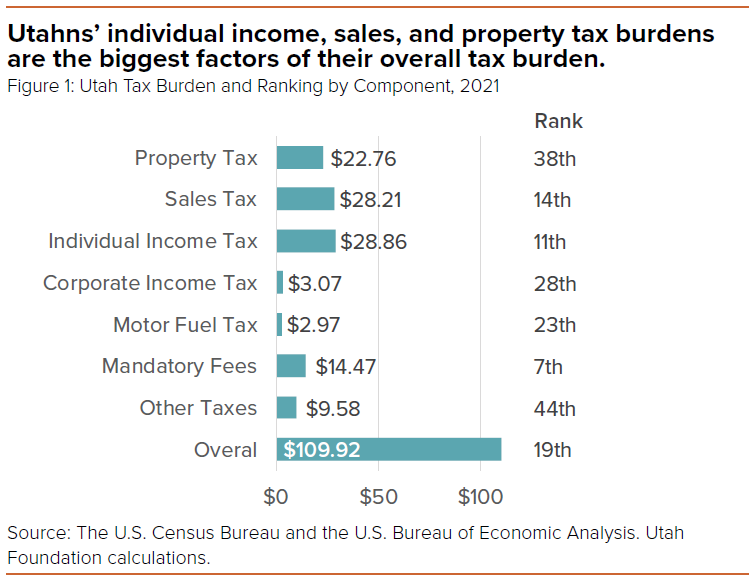

- Utahns’ overall tax burden in 2021 was $109.92 per $1,000 of personal income – slightly below the 10-year average.

- Utahns’ 2021 overall tax burden was up from 2016 when it was $104.50 per $1,000 of personal income – the lowest tax burden in at least 60 years.

- Utahns’ property tax burden in 2021 was $22.76 per $1,000 of personal income – the lowest property tax burden in the past 100 years.

- Utahns’ individual income tax burden has decreased from 2018, when it was at the highest point since the creation of the tax in 1931.

- Utahns’ personal income rose the fastest of any state from 2016 to 2021. Utahns’ tax burden also rose over the same time period meaning the tax collections increased even faster than the residents’ record personal income growth.