The American Dream is deeply embedded in the identity and ethos of the United States. At its core is the belief that anyone – regardless of their background – can achieve success, upward mobility, and a better life through hard work, determination, and opportunity. Homeownership is both a symbol of achieving the American Dream and a way it is achieved.

Policymakers are increasingly focused on housing as it has become a significant issue for voters in the local, state, and national elections of 2024 and beyond. These homeownership reports serve both as background for voters and a menu of options from which politicians might consider to address the problems being faced.

Highlights of this Report

- Recent household incomes were only about 20% higher than in 1985, while home prices had increased by 90% – adjusting for inflation.

- Housing affordability is at historical lows.

- The origins of Utah’s housing cost crisis predate the pandemic.

- Homeownership is associated with increased wealth and improved educational outcomes.

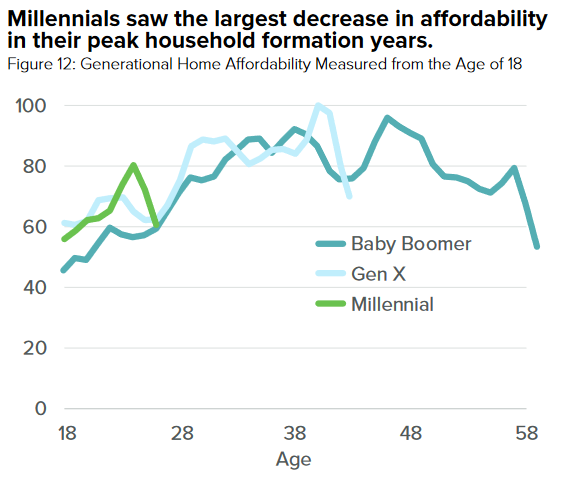

- Compared to older generations, millennials saw the largest decrease in housing affordability during peak household formation years.

- A shortage of housing construction and inventory, along with older Americans staying in their homes for longer periods, likely puts upward pressure on home prices.

- While there are certainly advantages to homeownership, it is important to recognize the drawbacks.

Given these realities, millennials are possibly delaying household formation as they face an unprecedented level of housing unaffordability. The housing affordability crisis affects more than just millennials; it affects anyone looking to become a first-time homebuyer. Ultimately, high home prices are putting the American Dream out of reach for a growing share of Utahns.

This is the first of two Utah Foundation reports exploring homeownership. This report:

- Highlights the various positive social and economic impacts of homeownership.

- Examines rates of homeownership over time.

- Details indicators of affordability.

- Investigates what is making homes unaffordable and the role of high prices in lowering ownership rates.

- Considers the potential role of interest rate changes on homeownership and the construction of housing inventory.

- Acknowledges that homeownership may not necessarily be preferable to renting in every circumstance.

The second report in this series explores policy options to increase homeownership rates.